Mortgages can have differing terms, including the number of years it will take to pay them off and also rates of interest. Every car loan program has its own distinct qualification demands. Gives financing of up to 100% with no needed down payment. Complying with are three governmental programs that are recognized to insure 100% finances. Mortgages without any down payment are usually offered just through specific government-sponsored programs. According to FHA guidelines, you can get a gift for the whole down payment.

Nonetheless, there is an in advance home loan charge equivalent to a percentage of the borrowed quantity. FHA finances allow you to purchase with just 3.5% down, however you then pay mortgage insurance for either 11 years or the life of the funding. This would certainly enable you to receive a conventional financing with less fees as well as no private mortgage insurance coverage required. Putting 20% down likewise minimizes the possibility you'll wind up owing more than your house is worth, so it can be much easier to obtain authorized for a finance.

- Keep in mind it can impact how much you're authorized for and also what your rates might be, and also it can make things hard in the future if the two of you different.

- A strong credit rating likewise indicates loan providers are more likely to be lenient in locations where you might not be as solid, such as your down payment.

- Home loans are only offered to those who have sufficient properties and earnings about their financial obligations to practically carry the worth of a home over time.

- When you do this, your home loan price will continue to transform, or float, as a result of market conditions till it's time to arrange your closing.

After an initial fixed-rate duration, your rates of interest rises or reduces as soon as each year. You're safeguarded from radical payment modifications by a rate of interest cap-- a safeguard that establishes the optimum amount your price can change. A limitation, such as that put on an adjustable price home loan, on just how much a month-to-month repayment or interest rate can enhance or reduce. The amount of your down payment aids give your lending institution the loan-to-value ratio of the residential or commercial property.

An FHA loan is perfect for newbie customers with less-than-perfect credit rating and offers down payments as reduced as 3.5%. Unlike traditional mortgages, home mortgage insurance consists of both an upfront quantity and also a regular monthly premium. You can obtain a traditional lending with a down payment of as low as 3% of the purchase cost of the residence.

Understanding The Mortgage Repayment Structure

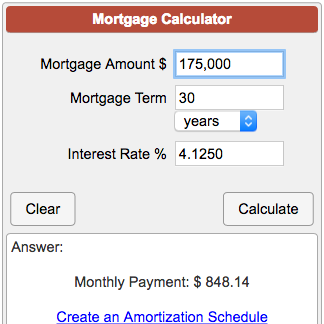

The balance is the full dollar quantity of a car loan that is left to be paid. It amounts to the loan amount minus the sum of all previous settlements to the principal. Refinancing is normally done to safeguard better loan terms, such as a reduced rate of interest.

Fha Finance Qualification Requirements

Asked for cash out is the quantity of money you're asking to get back from your home loan deal. It is necessary to bear in mind that your closing costs will certainly be subtracted from this quantity. The prime price is not the like the funding rate that's charged on personal effects finances; however, the prime lending rate is frequently made use of in determining home mortgages.

Rocket Mortgage

You need to discover a means to get back on track as well as start making your home loan repayments once more before the moratorium initiated by your mortgage insurance policy mores than. Personal Home mortgage insurance coverage, on standard loans might be included in your monthly settlement if you are putting much less than 20% down. FHA as well as USDA need a monthly home mortgage insurance payment, which will be consisted of in your complete regular monthly repayment. If you are light on capital or have a lower credit score, an FHA loan could be an excellent suitable for you. FHA financings can also profit an individual that has had a recent demeaning debt event such as repossession, insolvency, or a brief sale. If the debtor needs assistance in certifying, FHA car loans let relatives sign as non-occupant co-borrowers too.